MP Chris Philp refuses to confirm rise in benefits amid inflation

We use your sign-up to provide content in ways you’ve consented to and to improve our understanding of you. This may include adverts from us and 3rd parties based on our understanding. You can unsubscribe at any time. More info

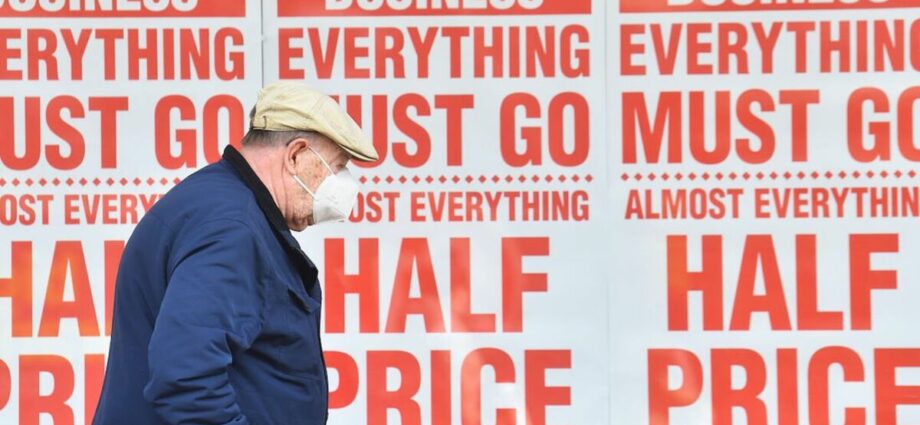

UK inflation has reached 10.1 percent, the Office for National Statistics (ONS) announced today. The ONS found the rate increased to five times the target in September, driven by surging gas and electricity bills and a jump in food and drink costs. And it is a 40-year high, with the rise from 9.9 percent matching the rate authorities recorded in July this year.

Is the UK in a recession?

High inflation throws uncertainty over UK finances, with benefits and pensions hanging in the balance given their reliance on the Consumer Price Index (CPI).

While inflation is distinct from recession, the former can serve as a precursor to the latter.

Rising prices harm economic growth, and recessions follow two quarters of GDP decline.

The ONS estimates that GDP fell by 0.3 percent in the three months to August 2022.

The decline followed 0.1 percent growth in the months to July, meaning the UK has only seen one quarter of economic contraction so far.

Those figures mean the country is not yet in recession, but not safe from one either.

Financial analysts believe the UK will enter a recession in 2023.

The UK is not in a recession right now, financial experts believe, but it could be by next year.

Independent financial analysts using the Ernst & Young Independent Treasury Economic Model (EY ITEM) expect the country will enter a recession from which it will not recover until mid-2023.

On October 17, the EY ITEM Club released its autumn forecast warning that “high energy prices, elevated inflation, rising interest rates and global economic weakness” would cause further economic contraction.

The forecasted 0.3 percent growth reduction would prompt a decline of 0.2 percent in the following two quarters from January to June 2023.

The EY ITEM forecast predicts GDP will see an overall contraction of 0.3 percent in 2023.

But the coming financial downturn would prove shallow compared to previous recessions.

Forecasters cited the Government’s “intervention on household and business energy bills” as the deciding influence holding off a deeper decline.

Following today’s inflation figures, Jeremy Hunt has promised to continue this approach.

In a statement, the Chancellor said the Government would prioritise aid for the most vulnerable Britons.

He said: “I understand that families across the country are struggling with rising prices and higher energy bills.

“This Government will prioritise help for the most vulnerable while delivering wider economic stability and driving long-term growth that will help everyone.

“We have acted decisively to protect households and businesses from significant rises in their energy bills this winter, with the Government’s energy price guarantee holding down peak inflation.”

Source: Read Full Article