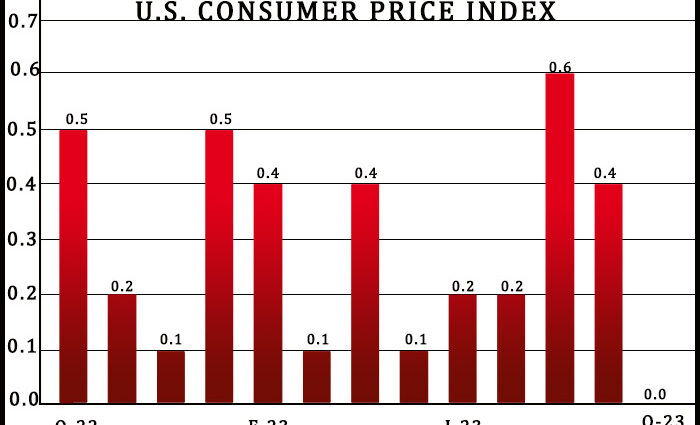

With a sharp pullback in gasoline prices offsetting a continued increase in shelter prices, the Labor Department released a report on Tuesday showing U.S. consumer prices came in unchanged in the month of October.

The Labor Department said its consumer price index was unchanged in October after climbing by 0.4 percent in September. Economists had expected consumer prices to inch up by 0.1 percent.

Consumer prices came in unchanged as gasoline prices plunged by 5.0 percent in October after jumping by 2.1 percent in September, contributing to a 2.5 percent slump in energy prices.

Meanwhile, prices for shelter rose by 0.3 percent in October after climbing by 0.6 percent in September, with higher prices for rent and owners’ equivalent rent more than offsetting a steep drop in prices for lodging away from home.

Excluding food and energy prices, core consumer prices edged up by 0.2 percent in October after rising by 0.3 percent in September. Core prices were expected to rise by another 0.3 percent.

The uptick in core prices reflected the increase in prices for shelter as well as a surge in prices for motor vehicle insurance. Prices for recreation, personal care and apparel also increased.

“The rise in core CPI was smaller than the gains seen in August and September, and the consensus forecast,” said Michael Pearce, Lead U.S. Economist at Oxford Economics.

“This mainly reflected a slower increase in shelter prices, as hotel prices fell sharply and owner equivalent rents rose at a sluggish pace,” he added. “A further slowdown in rental inflation is still baked in for the next few months.”

The report also said the annual rate of consumer price growth slowed to 3.2 percent in October from 3.7 percent in September. Economists had expected the pace of growth to decelerate to 3.3 percent.

Core consumer prices were up by 4.0 percent compared to the same month a year ago, reflecting the smallest year-over-year increase since September 2021.

The annual rate of core consumer price growth was expected to come in unchanged from 4.1 percent in the previous month.

Pearce said the slowdown in core price growth should “give Fed officials more confidence that inflation is on a firm downward trajectory, staying its hand for rate hikes.”

“However, the disinflation process still has some ways to go, and the path to weaker services inflation depends on a continued cooling in labor market conditions,” he added. “It will be a while before the Fed is confident enough to think about lowering interest rates.”

The Labor Department is scheduled to release a separate report on producer price inflation in the month of October on Wednesday.

Economists expect producer prices to inch up by 0.1 percent in October after climbing by 0.5 percent in September, while the annual rate of growth is expected to slow to 1.9 percent from 2.2 percent.

Source: Read Full Article

-

FDA Approves Bluebird Bio’s Gene Therapy For Rare Blood Disease

-

The 14 Least Trusted Institutions in America

-

Elon Musk Talks “Painful” Twitter Ownership, Updates On Blue Checks, BBC Government-Funded Tag, Staff Cuts, Dog CEO & More

-

Bob Chapek Tells D23 Disneyland’s Avengers Campus Expanding Again; Evolving Disney+ & Other Platforms So Viewers Are “Part Of The Action”

-

Russian Forces Committed War Crimes In Ukraine, Human Rights Watch Says