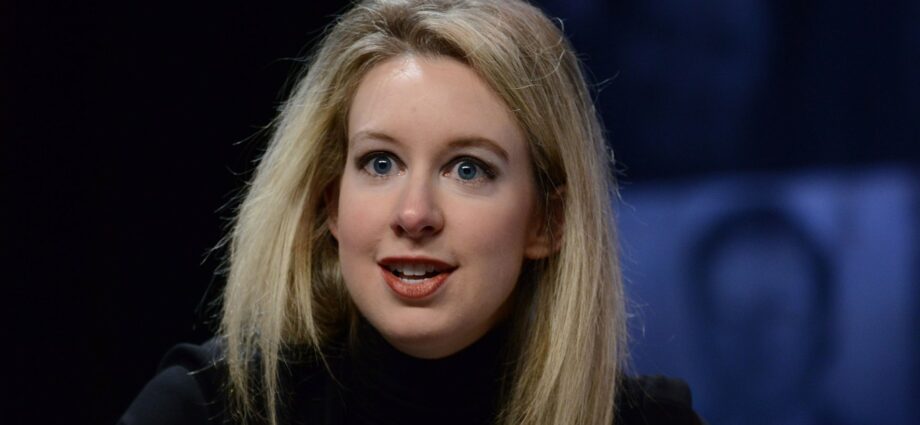

Elizabeth Holmes, the disgraced founder of Theranos, reported to prison in May. She recently had her 11 year sentence reduced by 2 years, possibly for good behavior. After being convicted of wire fraud and sentenced to 35 months. Holmes, not long ago, became the youngest female billionaire, but that was based on the extremely faulty valuation of her company. It is rare for a person who has reached the status of billionaire to ever lose it — but it is not unheard of. Most people with the business savvy to amass billions of dollars also know how to maintain their fortune. Occasionally, however, someone who was at one time worth billions sees their net worth drop to near zero.

24/7 Wall St. researched reports of wealthy individuals who lost their fortune. We found more than a dozen billionaires who have gone broke.

Typically, the billionaires on this list lost their money either because of bad investments or criminal activity. Several are notorious scammers who raked in billions of dollars by lying to investors or cooking the books to make their business appear more successful.

Other people on this list gained their billions through divorce but were unable to maintain their wealth, either because of bad investments or lavish spending.

The ultra wealthy can generally stay rich by diversifying their holdings to protect themselves from economic turmoil as well as by hiring the top money managers that can help shield them from recessions. Throughout the COVID-19 pandemic and resulting financial fallout, the net worth of America’s 614 billionaires grew by over $900 billion, collectively. These are the American billionaires that got richer during COVID.

Click here to see billionaires that have gone broke

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Source: Read Full Article