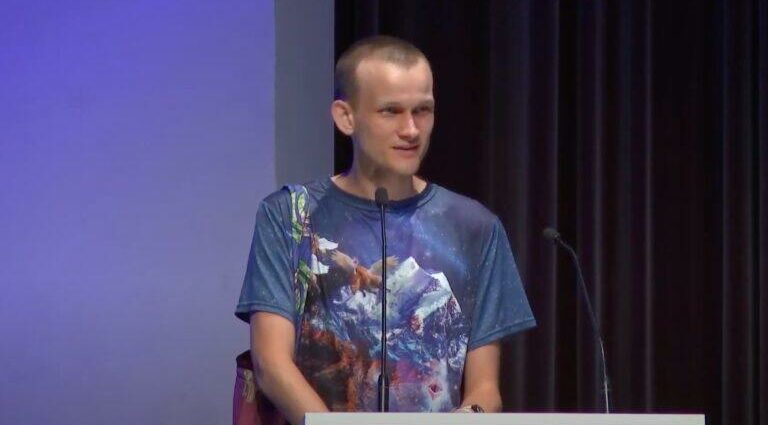

Recently, Ethereum Co-Founder Vitalik Buterin explained why he is “actually kinda happy” that so many crypto ETFs have been delayed in the U.S. (due to the lack of interested by the U.S. SEC to approve any such proposals).

On 30 October 2022, Buterin wrote on Twitter:

“Should I publicly blab my opinions about crypto regulation more? Feels unfair to let other people get attacked by CT but never actually poke my own head out… I don’t think we should be enthusiastically pursuing large institutional capital at full speed. I’m actually kinda happy a lot of the ETFs are getting delayed. The ecosystem needs time to mature before we get even more attention…

“Basically, especially at this time, regulation that leaves the crypto space free to act internally but makes it harder for crypto projects to reach the mainstream is much less bad than regulation that intrudes on how crypto works internally… The ‘KYC on defi frontends’ idea does not seem very pointful to me: it would annoy users but do nothing against hackers. Hackers write custom code to interact with contracts already. Exchanges are clearly a much more sensible place to do the KYC, and that’s happening already…

“Basically, there’s two main classes of regulatory policy goals: (i) consumer protection, (ii) making it harder for baddies to move large amounts of money around. The issues around (ii) are concentrated not in defi, but in large-scale crypto payments in general… Regs on defi frontends that could be more helpful may include: (i) limits on leverage (ii) requiring transparency about what audits, FV or other security checks were done on contract code (iii) usage gated by knowledge-based tests instead of plutocratic net-worth minimum rules…

“Also, I would love to see rules written in such a way that requirements can be satisfied by zero knowledge proofs as much as possible. ZKPs offer lots of new opportunities to satisfy reg policy goals and preserve privacy at the same time, and we should take advantage of this!“

As CoinDesk reported, on 29 June 2022, the SEC rejected Grayscale Investments’ spot Bitcoin ETF proposal, a decision that did not surprise Grayscale Investments (a subsidiary of Digital Currency Group), which immediately filed a petition for review of this decision in the U.S. Court of Appeals for the District of Columbia Circuit.

On 30 June 2022, when CNBC anchor Melissa Lee asked Grayscale Investments CEO Michael Sonnenshein if there is “a precedence for this sort of action to sue the SEC for a rejection”, he replied:

“We laid out these arguments throughout the last couple of months leading up to this decision, really looking at the fact that the SEC is acting arbitrary and capricious by continuing to approve Bitcoin futures base ETFs, while continuing to deny spot Bitcoin ETFs.

“And when you look at the administrative procedure act, which is really what governs the way that regulators have to govern, they have to be treating like issues alike, and in this case, they’re not. They’re actually discriminating against issuers like Grayscale, who are trying to bring a product further into the US regulatory perimeter here.“

Shortly later, Scaramucci, who is the founder and managing partner of global alternative investment firm SkyBridge Capital, gave an interview to CNBC’s “Squawk Box”, where he had this to say to co-anchor Andrew Ross Sorkin about the SEC’s continual refusal to approve any spot Bitcoin ETF proposals:

“It’s a missed opportunity for the country. We’ve had the mantle of financial services leadership for a hundred plus years. And the fact that the SEC is moving in this direction, where the Europeans are allowing for a cash ETF, the Canadians are allowing for a cash ETF, just a huge missed opportunity. You know, the SEC now stands for ‘Stop Economic Creativity’, and I think that is a terrible thing for the country.

“Moreover, they won’t even give me the regulations, Andrew. You know, they’ve hired more people in the enforcement division, and so the venture capital community, the crypto community are like ‘okay, so we’ll find out what to do if you’re investigating us’…

“Why don’t you put down in writing what the regulations are and the rules. We’re all lawing citizens, and we’ll happily abide by the rules. And so, this vagueness and this uncertainty, I think, is hurting the United States and it’ll hurt our intellectual capital and our capital formation going forward. So, I hope they stop it.“

Source: Read Full Article

-

McGlone: Bitcoin's Major Price Hikes Waning?

-

Is $135,000 The Next Stop For Bitcoin? Rich Dad Poor Dad Author Thinks So

-

Satoshi-Era Bitcoin Whale Moves $1.2 Million Worth Of BTC After 13 Years

-

Cryptos Subdued Ahead Of Earnings Updates From Wall Street’s Tech Space

-

Immunome Surges On News Of Merger With Morphimmune