Economic Outlook and Market Trends

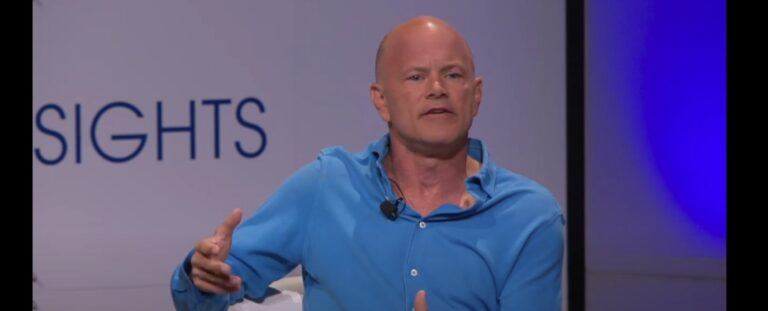

Mike Novogratz, the founder and CEO of Galaxy Digital, shared his perspectives on the current economic climate and market trends during an interview with Sonali Basak on Bloomberg Television. Novogratz anticipates a significant economic slowdown in the first quarter of 2024, leading to the Federal Reserve cutting rates towards the end of the first quarter or the beginning of the second. He highlighted the uncertainty in the market, particularly regarding the extent of rate cuts, which could stimulate ‘animal spirits’ and positively influence the yield curve.

Novogratz expressed a shift in his stance from a long dollar bias to a short dollar bias, favoring the Euro and other currencies while maintaining a short position in the Chinese currency due to structural issues. He also sees potential in gold and silver, especially if the Federal Reserve ceases rate hikes and begins cutting rates.

Cryptocurrency and Blockchain Industry

Discussing the crypto industry, Novogratz commented on the recent settlement between Binance.US and the US Department of Justice. He views the settlement as a positive development for both Binance and the broader crypto industry, reducing risks and concerns associated with dealing with Binance. Novogratz believes that the industry has become cleaner and more stable following the 2022 crash, with many bad actors being eliminated.

He remains optimistic about Bitcoin’s future, especially with the anticipation of a spot ETF launching in the US in 2024. Novogratz predicts a significant influx of investment into Bitcoin, potentially driving prices higher, especially in the context of a rate-cutting cycle by the Fed.

2024 US Presidential Election

Regarding the 2024 US presidential election, Novogratz expressed a desire for generational change, showing reluctance to support candidates from the baby boomer generation. He is open to bipartisan candidates and is particularly interested in those who represent a departure from the current political landscape. Novogratz mentioned potential support for candidates like Chris Christie, Nikki Haley, and Neil Phillips, emphasizing the need for a shift away from divisive figures like Donald Trump and Joe Biden.

Final Thoughts

Novogratz concluded the interview by discussing the potential impact of an ETF on the Bitcoin market. He expects significant investment, possibly up to $10 billion in the first year, which could substantially influence Bitcoin’s price. This development, according to Novogratz, would mark a pivotal moment in the crypto industry, signaling a broader acceptance and institutional interest in Bitcoin and potentially other cryptocurrencies.

https://youtube.com/watch?v=ics9P_tXwq0%3Ffeature%3Doembed

Source: Read Full Article

-

Rate Hike Fears Dampen Market Sentiment

-

Ritchie Bros. Auctioneers Dips 18% Following Decision To Buy IAA, Inc.

-

$291 Billion Asset Manager Predicts Bitcoin's Rise To $150,000 Post-Halving

-

Elon Musk Fires Back At Twitter with a Counter Lawsuit

-

Despite Bitcoin’s 70% Rally, ‘Historic Undervaluation Remains’, Explains Crypto Analyst