The Central Banks of Israel, Norway, Sweden, along with the Bank for International Settlements Innovation Hub, are set to jointly explore retail central bank digital currencies (CBDCs) for international settlements. Dubbed the Project Icebreaker, it aims to use CBDCs to achieve faster and cheaper, as well as more transparent and inclusive cross-border payments.

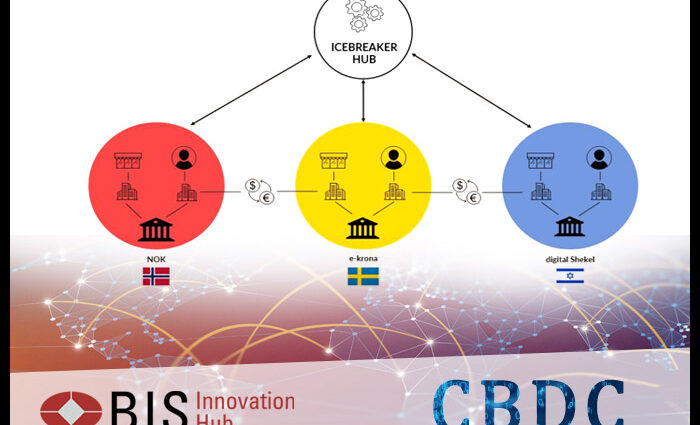

Project Icebreaker is a collaboration between the Bank of Israel, Central Bank of Norway, Sveriges Riksbank (Sweden) and BIS Innovation Hub Nordic Centre to develop a “hub” to which participating central banks will connect their domestic proof-of-concept CBDC systems.

The objective of the project is to test some specific key functions and the technological feasibility of interlinking different domestic CBDC systems. The architecture is designed to enable immediate retail CBDC payments across borders, at a significantly lower cost than with existing systems.

The project will run through the end of the year, with a final report expected in the first quarter of 2023.

Cross-border payments continue to be plagued by high costs, low speed, limited access and insufficient transparency. These three countries are looking to join forces with BIS to support the G20 roadmap for improving cross-border payments.

The BIS Innovation Hub and other international institutions and standard-setting committees have been working together to investigate the use of CBDCs for cross-border payments.

A year ago, the Central Banks of Australia, Malaysia, Singapore and South Africa, along with the BIS set out on a joint pilot for international cross-border settlements with CDBCs issued by multiple central banks.

In January 2021, The BIS, also known as the central bank of central banks, had included exploring CBDC feasibility as one of the six key areas set out in its annual work program for 2021.

CBDCs are slated to be the digital equivalent in value to a nation’s paper currency and are subject to the same government-backed guarantees. In addition to printing money, central banks can issue CBDCs as a digital representation of a country’s fiat currency. CBDCs are expected to be used for interbank settlements.

While the global economy races to embrace digital payments, central banks also are looking to investigate and support innovation while maintaining monetary policy and financial stability as they issue and distribute currency.

Source: Read Full Article

-

Markets Wait For Monetary Policy Cues From Economic Data

-

$BTC: BitMEX Co-Founder Offers Two Possible Explanations for Bitcoin’s Current Rally

-

Sphere Entertainment Shares Rise In Morning Trade

-

Bitcoin Price Could Easily Double Under CFTC-Led Regulation, Chair Rostin Behnam Reckons

-

Cryptos Subdued Ahead Of Earnings Updates From Wall Street’s Tech Space