During an interview with CNBC’s “Squawk Box” on September 1, former SEC Chair Jay Clayton acknowledged that regulating crypto is a challenging task. He pointed out that when crypto first entered retail markets, many people used it to develop products that were not compliant with U.S. securities laws and that the SEC had to intervene to regulate these offerings. Now, he said, the SEC faces the challenge of distinguishing between securities and non-securities offerings in the crypto space, including stablecoins.

When asked if he would have approved a Bitcoin ETF if he were still in the chair, Clayton refrained from giving a direct answer. However, he emphasized that Bitcoin is not a security and that both retail and institutional investors are interested in it. He also noted that some of the most trusted providers want to offer Bitcoin products to the retail public. Clayton said he believes that the approval of a Bitcoin ETF is inevitable and that the current dichotomy between futures products and cash products cannot continue indefinitely.

He also expressed his belief that large institutions with surveillance mechanisms are now saying that cash trading in Bitcoin is not easily manipulable, which could be a shift in the SEC’s assessment, and went on to say he did not see any new reasons for the SEC to reject Bitcoin ETF applications.

https://youtube.com/watch?v=WudbiBkZBC0%3Fstart%3D274%26feature%3Doembed

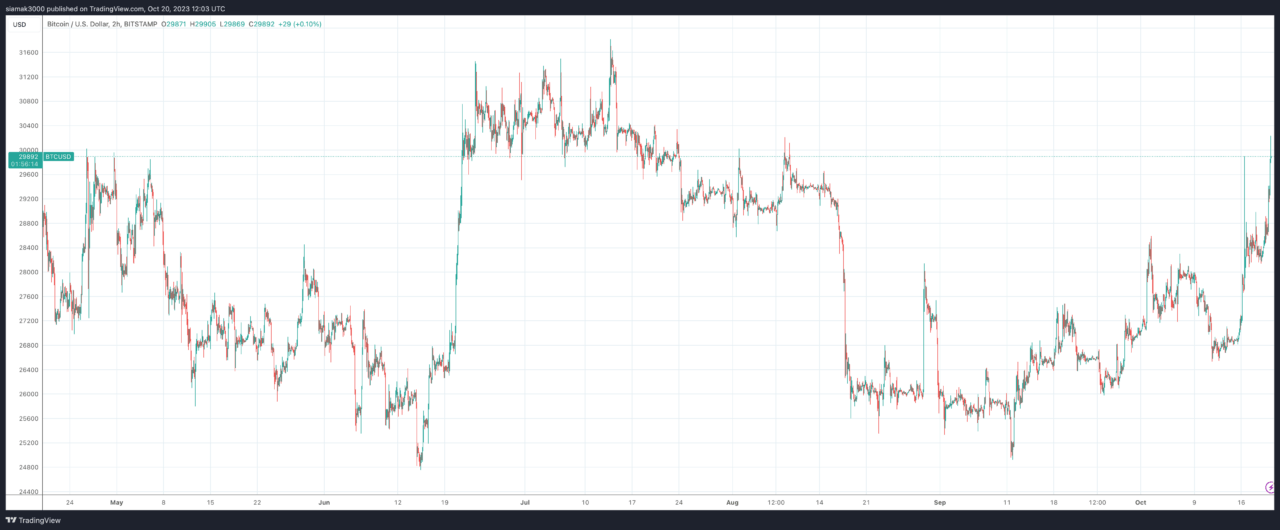

Well, around 10:23 a.m. UTC on October 20, thanks to the increasing amount of optimism around the approval of a Bitcoin spot ETF by the SEC in the next few months, on crypto exchange Bitstamp, the Bitcoin price went back above the $30,000 level for the first time since July 23. This move above the $30K level comes just 50 days after Clayton said that the approval of a Bitcoin spot ETF in the U.S. is “inevitable.”

In the past 24-hour period, seven-day period, and year-to-date periods, the Bitcoin price is up 5.16%, 11.39$, and 80.10%, respectively.

As for when we are likely to see the SEC approve a Bitcoin spot ETF, according to a research report released by J.P. Morgan on October 18, this is expected to happen “within months.”

Featured Image via Midjourney

Source: Read Full Article

-

Markets Rise As Inflation Worries Ease

-

Ledger’s CEO Believes in Bitcoin as a Safe Haven Against Centralization

-

JinkoSolar Adds 10%; Launches Second Generation Tiger Neo Panel Family

-

FREYR Battery Down 10% After Pricing Public Offering Of 20 Mln Shares

-

Bitcoin's $28,000 Hurdle Sparks Red Monday for Cryptocurrencies