TL;DR:

- Blockchain data from crypto intelligence firm Nansen and Arkham Intelligence identified a couple of transactions completed on a wallet identified as Mashinsky’s.

- The wallet sold 17,475 CEL and swapped them for 28,242 Ether, according to Etherscan.

- Mashinsky is reportedly one of the largest Celsius Token holders after the Celsius treasury.

- Celsius filed for bankruptcy protection on July 13 after freezing withdrawals on their app due to financial difficulties.

The CEO of Bankrupt crypto lender Celsius allegedly sold large amounts of the CEL token in the recent token surge. The token increased almost 2x in the past week in what looks to be a community-driven short squeeze.

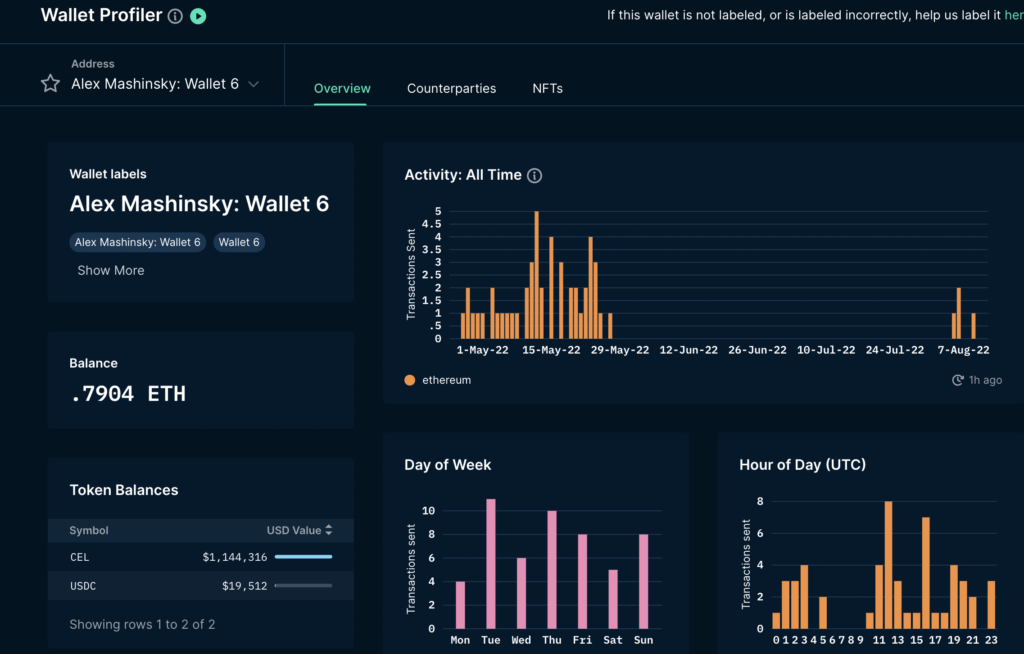

Blockchain data obtained from well-known crypto intelligence firms Nansen and Arkham intelligence have managed to identify many of Mashinsky’s wallets on the blockchain. According to Nansen, the Mashinsky Identified Wallet 6 became active after staying dormant since May and started making its first transactions. According to Etherscan data, Mashinsky’s alleged wallet swapped Celsius for Ether, selling 17,475 CEL for $28,242 worth of ether (ETH) using Uniswap (a well-known decentralized exchange).

Arkham Intelligence identified a few Mashinsky wallets that have regularly sold large amounts of the CEL token on various decentralized exchanges. Before bankruptcy, Celsius listed its largest owners on their web page, with Mashinsky reportedly being the largest Celsius token holder just after the Celsius treasury.

Celsius filed for bankruptcy protection on July 13, just a month after freezing customer withdrawals in June. The CEL Coin issued by the company also faces regulatory scrutiny from the SEC for not being registered as a security.

Source: Read Full Article

-

Ripple's $XRP Lawsuit Could Soon Be Settled, Crypto Legal Expert Suggests

-

SEC ‘Failed To Carry Its Burden As to Each of the Three Howey Elements’ in $XRP Case, Ripple’s Lawyers Say

-

Little-Known Cryptocurrency Threshold ($T) Surges Over 200% in 30 Days

-

XRP Price Outperforms Other Top Cryptocurrencies to Surpass BNB After 27% Weekly Rise

-

Cardano-Based SingularityNET ($AGIX) Maintains 1,000% Rally as Elon Musk Works on New AI Research Lab